2024 1040 Schedule Send – Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” With these two forms, you are able to report your business profits and losses and calculate the amount of unemployment tax you owe. . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D did you receive, sell, send, exchange or otherwise acquire any financial interest in .

2024 1040 Schedule Send

Source : thecollegeinvestor.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comIRS e file Refund Cycle Charts

Source : igotmyrefund.comWhen will the IRS start accepting tax returns in 2024? When you

Source : www.livenowfox.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

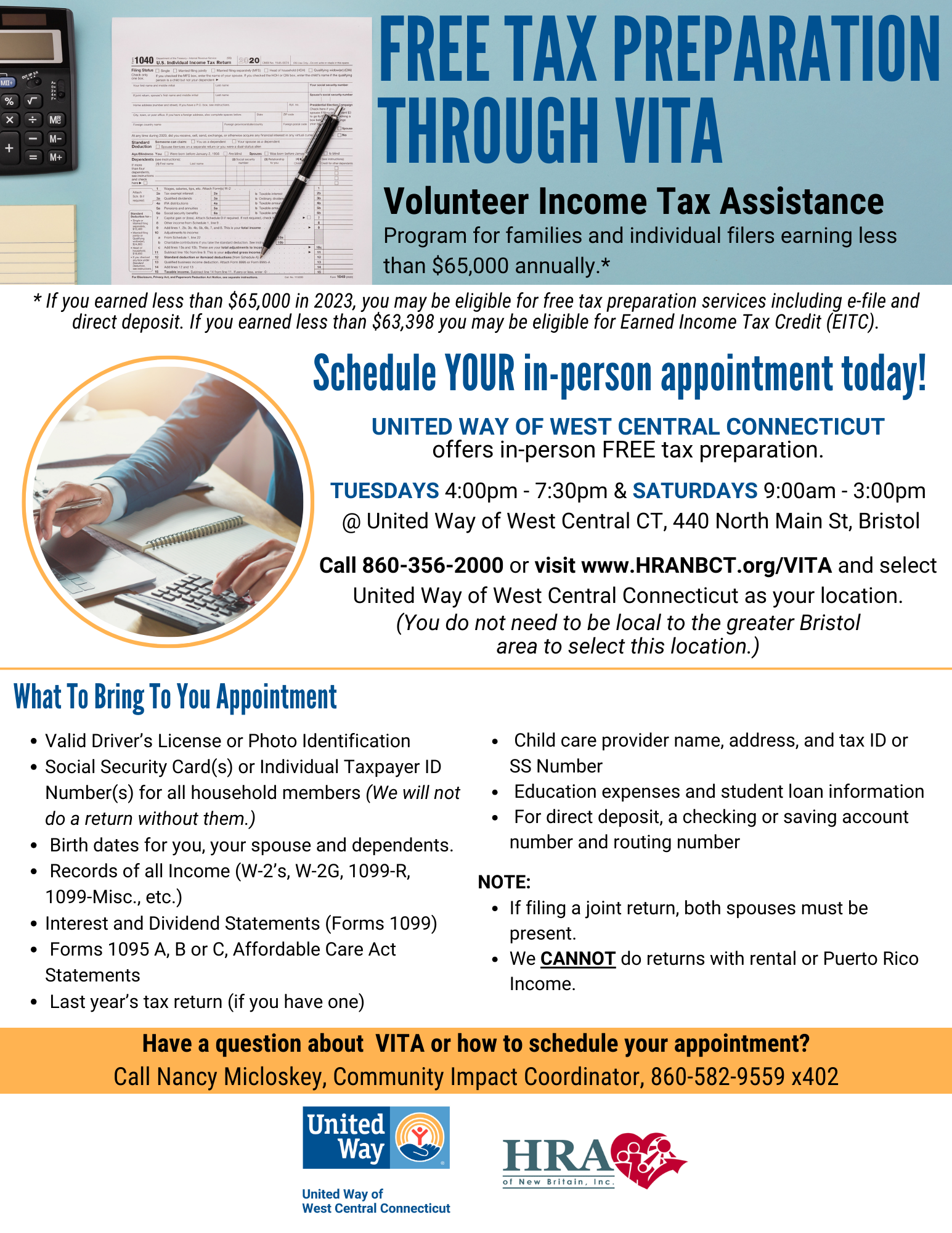

Source : www.bscnursing2022.comFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comIRS Tax Refund Calendar 2024: Check expected date to get return

Source : ncblpc.orgIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.com2024 1040 Schedule Send When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. . This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. .

]]>